US Banks’ Loan Losses Hit $19bn in the Second Quarter

The second quarter has not been kind to US banks, with their quarterly results reflecting an increasingly grim picture of the banking sector.

Many banks have responded by allocating larger provisions against loan losses – an acknowledgment that current cycle of monetary tightening may still continue and further credit deterioration could follow.

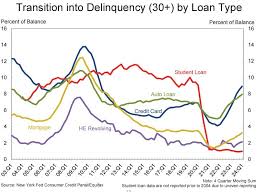

Credit loss allowances have increased due to a sharp rise in defaults among US borrowers with variable-rate loans, particularly variable rate mortgage loans. This trend stems from an economic slowdown that has affected consumer spending and investment decisions; as well as economic uncertainty caused by slow job creation which has caused more people to default on their debt payments and miss repayments altogether.

These factors have been compounded by rising interest rates. Following the Federal Reserve’s post-Covid rate hike this year, investors rushed out of bonds in droves, driving prices of those securities down and leaving many US banks holding trillions worth of losing bonds that have left holes in their balance sheets and others with an uncertain financial standing.

Recent economic turmoil has also forced more Americans to increase borrowing at the Federal Reserve’s discount window and Federal Home Loan Banks (FHL Banks), regional government-chartered institutions that raise money from members for low-cost lending to members – usually as a last resort during times of crises.

As a result, US banks now hold less capital than they did several years ago, while their profit margins have diminished drastically – impairing their ability to repurchase assets on secondary markets and leading to the reduction of the banking system in general.

As a result, bank failures have witnessed a rise. Just in March alone, regulators seized Silicon Valley Bank and Signature Bank within days of each other, while New Century Financial filed for bankruptcy protection. Meanwhile, Citigroup shares dropped 17% after reporting an $81.9bn write-down related to subprime mortgage exposures.

Though most large banks have seen better profits year-on-year, small banks have fared less well. An analysis by S&P Global Market Intelligence indicates that half of small and mid-sized banks reporting third quarter earnings had higher loan loss provisions; an improvement from two thirds in the first quarter. Furthermore, most of these banks reported increased charge-offs and nonaccrual loans.