Recent News Within the Personal Loan Industry

Consumers generally use personal loans to finance home improvement projects or consolidate credit card debt, but borrowing money for other

purposes such as buying a car, funding a vacation or covering wedding costs are all valid uses of borrowing – or to begin businesses or purchase homes altogether.

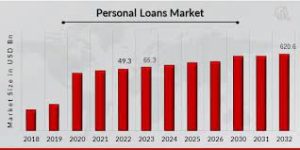

Consumer borrowing – particularly of unsecured personal loans — has seen exponential growth over recent years. Outstanding personal loan balances across generations have increased sharply while interest rates have also spiked significantly; as a result, total personal loan costs have skyrocketed and delinquency rates continue to climb.

These trends are concerning as those with the highest levels of personal loan debt tend to be those least capable of managing it. Furthermore, as the economy struggles with rising inflation and interest rates in 2024 more individuals may default on their personal loans.

And while borrowers struggle with personal loan balances, banks continue to dole out credit at an exponential pace – according to TransUnion data, the average personal loan balance has increased 54% since COVID-19 emerged. While rising credit scores and decreased income may account for some of this surge in personal lending activity, financial technology (FinTech) innovations are driving it as well.

FinTech companies, internet platforms and market-based lenders (formerly P2P lenders) converged during the 2000s to transform personal credit industry, making unsecured personal loans increasingly desirable financial products for consumers. Furthermore, economic headwinds caused by global recession accelerated demand for these types of loans.

As personal loan competition rises, some of the leading players are expanding their presence through acquisitions and new product offerings. Navia and Piramal Finance recently joined forces to offer an online personal loan; their aim is to offer convenient financial products and services tailored specifically for customers with various credit needs.

Personal loan market diversification has increased as more institutions enter the sector. A diverse credit portfolio helps distribute risk more evenly while encouraging more inclusive financial development; fintech innovations are particularly helpful in expanding access to low- and moderate-income consumers who were previously dependent upon less desirable alternatives.

For instance, the New York Federal Reserve’s Community Development team published a research brief examining fintech companies’ role in offering unsecured personal loans to low and moderate-income Americans. Their study used 2017-2023 TransUnion data to investigate alternative data and underwriting practices that have expanded access to these loans; as a result 22.7 million American borrowers possess one and most obtained it through fintech firms – most used it for debt consolidation especially revolving credit debt consolidation purposes.