News About the Commercial Loan Sector in the USA

In the United States, commercial loans are an invaluable source of financing for businesses. Used for everything from inventory purchases and

working capital funding to real estate finance or debt repayment, commercial loans often require collateral such as property, plant or equipment which banks can seize if there is default or bankruptcy; typically used as short-term solutions like lines of credit, term loans or mortgages with longer-term options secured by receivables or future cash flows as security.

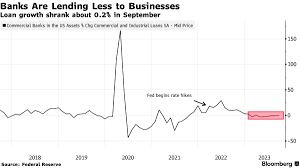

As the economy slows down, commercial loan delinquencies are on the rise and banks have had to reduce their lending portfolios – this will likely result in decreased lending activity nationwide and have an adverse effect on consumers obtaining car loans or other forms of consumer credit.

Regional and community banks may further limit lending in commercial real estate due to substantial exposure. They could potentially experience losses should office vacancy rise and property values decrease.

Silicon Valley Bank (SVB) and Signature Bank’s recent collapse is an illustration of the risk associated with regional banking crises that could spiral through an economy into recession. Regional banks hold significant CRE loans that make them especially susceptible to changes in commercial real estate market dynamics.

Regional banks have responded by tightening credit standards and scrutinizing existing loans, with higher interest rates pushing margins lower and reducing loan loss reserves. This trend is likely to continue over the coming months.

The decline of oil prices has also had a detrimental impact on commercial loans. Energy companies made up an important share of commercial lending during oil’s boom period; now as it drops further, these firms are struggling to remain profitable and this has led to an increase in loan delinquencies and decreased total lending by community banks.

Though SVB and Signature Bank’s collapse has increased concerns about banking sector health, most experts don’t predict a repeat of events from 2008 when nine regional banks collapsed. This is likely due to increased diversification within US banks that has led to less small to midsized institutions having high exposures to commercial real estate or energy markets.

With the Federal Reserve expected to raise interest rates in 2023, commercial mortgage loans that come due during an era when office vacancy rates are increasing and property values are falling could pose a time bomb for CRE sectors already facing an excess supply of inventory and declining sales; banks that hold these mortgages may write down their value or limit new lending which could have an indirect effect on the wider economy.