How Loan Services Can Improve Small Businesses’ Bottom Lines

Business can often require extra funds in order to take the next steps forward, and if your small company is finding itself short of cash it may be time

to seek assistance through loan services. Although no one wants debt, taking out loans may help expand and improve your bottom line.

Loan servicers play an essential part in making loans accessible and manage all aspects of their administration – they collect payments, maintain records and respond to inquiries as well as managing escrow accounts to pay taxes and insurance on your behalf. Loan servicing companies receive compensation by collecting a small percentage of each consistent payment made.

Loan servicing used to be a core function for banks; however, securitization has reduced its profitability significantly and caused many financial institutions to outsource this function to third-party firms who specialize in it. This allows them to focus more on client acquisition while cutting overhead costs.

An optimal loan portfolio strengthens your company’s creditworthiness while mitigating risks while catering to diverse customer segments. But to achieve maximum impact from this lending business endeavor requires strategic differentiation as well as an advanced data management system capable of responding swiftly to regulatory change and market competition.

To combat these difficulties, many lenders are revamping and right-sizing their operations in response to these new realities. Many are embracing automation tools such as digital platforms and data analytics in order to provide a superior borrower experience while increasing efficiency and decreasing compliance risk.

These changes are impacting all industries – from large tech firms and fintechs to community development finance organizations – yet how will these affect small businesses, and can they adapt?

Yes to both questions; provided they embrace innovation. Small business owners possess an advantage when it comes to borrowing due to not having as many financial constraints than their larger competitors, giving them more room to adopt innovative practices and expand the reach of their products and services.

Not only must lending institutions leverage technology, they must take an inclusive and collaborative approach when engaging borrowers and develop more flexible products if they hope to stay competitive against non-bank lenders and fintech firms while simultaneously keeping existing customers.

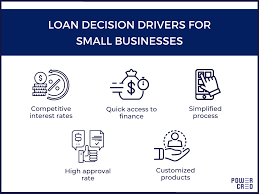

Small business loans will continue to become increasingly popular as lenders offer more favorable terms and products that facilitate access to capital for borrowers, benefitting both the economy and borrowers themselves. It’s essential for small businesses to carefully weigh any costs against potential benefits when considering whether to take out a loan.

Loan services can help your business by managing payments and offering financial guidance to borrowers. Furthermore, loan services connect businesses to experienced experts when any issues arise such as foreclosures or tax-related disputes – saving both time and money while improving customer experiences overall.