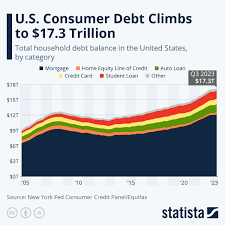

Household Debt Statistics – Average American Debt in 2024

Americans continue to carry an abundance of debt. Although credit card, auto loan, and mortgage balances increased last year, other forms of

consumer debt actually saw declines – such as personal loans and home equity lines of credit (HELOCs) which both saw double-digit decreases due to refinancing strategies which help to consolidate higher interest balances or reduce interest rates; such debt reduction strategies often coincide with slowing housing markets.

Due to these considerations, it’s vitally important to examine American debt totals and averages by state, age group, credit score risk factor and other categories. We compiled this information using Experian data with additional Fed and New York Federal Reserve Bank data adjusted for inflation.

Average debt per American increased by $543 billion between Q1 2020 and 2024, with mortgage balances increasing 5.9 percent and auto loans increasing 6.5% respectively. Credit card and auto loan delinquency rates did decrease during the COVID-19 pandemic; however, they have yet to return to pre-pandemic levels.

Mortgage balances represent the bulk of Americans’ debt, with an average mortgage holder owing $220,380 as of Q1 2024. Student loan and auto loan debt were next on the list followed by credit cards owed. Debt tends to peak during middle age before decreasing with retirement age – except in terms of mortgage debt for people over 65.

Income, education and age all play a factor in how much debt a person carries. One major cause is more low- and middle-income students attending college with student loan debt; many also end up working entry-level positions that pay less than what their schooling cost them; this exacerbates this trend further.

Medical debt is another significant contributor to rising American debt levels, particularly among black and Hispanic people. Furthermore, bills tend to be higher in states without Medicaid expansion, and as people approach retirement they typically possess fewer financial assets, making it more challenging to cover expenses in an economic downturn.

Those struggling with debt should seek assistance from a certified credit counselor, such as Accredited Debt Relief. A credit counselor can help develop a debt repayment plan tailored specifically for your budget while devising ways to eliminate it altogether. Contact Accredited Debt Relief now for your free debt consultation; with programs available nationwide we can assist you on the road back towards debt-free living!