Current Loan Interest Rates For Young People

Are You One of the Three in Ten Adults Carrying Student Loan Debt? Interest charges add a considerable sum to the money owed. In order to

maximize the use of your financial resources, it’s essential that you understand how interest rates work and which factors influence them.

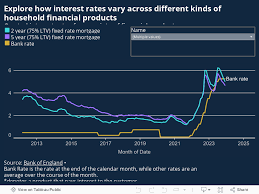

The table below presents current loan interest rates for young people and compares them with historical averages, as well as refinance rates for federal and private loans. Your individual rate may depend on your credit score, income (or that of a cosigner) and loan term – two ways of potentially lowering it further. You could potentially reduce it even further by repaying faster or shortening it further.

Personal loan lenders utilize risk-based pricing to set their interest rate, taking into account your credit score, income and payment history to assess how likely it is that you will default on repayment obligations and thus get lower rates than those with lower scores.

As part of their loan approval process, lenders will also assess how much of your income goes toward debt payments – also known as your debt-to-income ratio – which will determine your loan’s interest rate. A higher debt-to-income ratio signals to lenders that you pose more of a risk, leading them to charge a higher interest rate to compensate.

Each spring, Congress determines the interest rates on federal student loans based on the high yield of a 10-year Treasury note auction. These fixed rates don’t take into account your credit or income history and offer more flexible repayment options than private student loans. Federal student loans offer especially good value to students seeking affordable education solutions with more favorable repayment terms than their private counterparts.

Federally-subsidized and unsubsidized loans do not typically offer lower interest rates than private loans, however subsidized borrowers don’t pay interest while attending school or during grace and deferment periods, so their advantages could help offset any difference in rates.