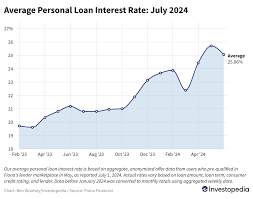

Average Personal Loan Rates for July 2024

Finding the ideal personal loan rates may depend on factors like lender, credit score and financial history; generally speaking, however, an

ideal rate falls below the national average.

Personal loans can be an effective tool to manage expenses, but it’s essential that consumers fully comprehend the rates and terms associated with such loans before taking out one. Interest rates can be quite high; sometimes even coming with an origination fee; as well as being mindful of this aspect, as well as being aware of total cost including principal and fees.

Personal loans are an unsecured form of consumer debt that are frequently used for expenses like weddings, home improvement projects, medical bills or travel. Their amount and terms depend on various factors including credit scores, income and debt to income ratio (DTI).

Borrowers with good to excellent credit scores (690 and higher) typically get the best personal loan rates as lenders view them as lower risk applicants. Conversely, those with fair to poor credit (defined as credit scores between 400-599) may incur higher rates and have limited loan options available to them when shopping for personal loans. Stable income, managing debt well and on-time payment records all play a part in receiving the best personal loan rates possible.

Interest rates on personal loans have seen slight increases over the last year, yet remain lower than credit card interest rates. Most personal loan terms range between three and five years; some lenders provide shorter-term options.

Online lenders that specialize in working with borrowers from varying credit levels and income brackets tend to offer the cheapest personal loan rates, often at considerably cheaper rates than traditional banks. Although they may charge slightly higher interest rates to borrowers with poorer credit than traditional banks do, this makes them an excellent option for individuals who require quick and hassle-free financing solutions.

Some large traditional banks provide competitive personal loan rates for existing customers. These banks may even provide loyalty rate discounts to borrowers with longstanding relationships and an excellent track record of making payments on time. Furthermore, these banks have extensive branch and ATM networks for those preferring in-person service.

Credit unions can also provide affordable personal loan rates. As these lenders usually operate with a small group of members and often have more relaxed lending criteria than banks, credit unions often offer loan programs for people with fair to poor credit who need personal loans. Some also provide competitive rewards programs with their personal loan rates .To find the ideal rate, borrowers should visit multiple lenders and compare interest charges against their unique situation in order to determine which offer the most affordable interest charges over time. This way they may avoid overly-excessive rates that add thousands in additional charges over time!