Average Business Loan Interest Rates in July 2024

Finding the most competitive business loan rates in 2024 depends on a number of factors, including your lender, type of financing and total

amount borrowed. You can reduce costs by shopping around for better offers and refinancing or paying off debt as quickly as possible.

Your chances of securing a loan can also be enhanced by taking steps such as credit card management and debt consolidation, disputing errors on your credit report and making payments on time. If these methods don’t work out for you, alternative financing solutions such as microloans and crowdfunding may offer viable solutions.

The average business loan interest rate in July 2024 depends on various variables, such as your lender, type of financing and amount you plan to borrow. Some lenders offer lower interest rates for borrowers with strong credit profiles, multiple years in business and robust revenue streams; others may charge higher rates if financing specific industries or riskier borrowers; your lender will also take into account how creditworthy your business is assessed through personal and company financials.

As part of your application process, lenders may request detailed income and expense statements, cash flow analyses and profitability documents from you as part of their approval process. Some lenders may even have revenue or cash flow requirements similar to credit score requirements for businesses seeking financing. It’s essential that as much information about your business be shared with potential lenders in order for them to assess it accurately as an investment and offer you suitable loan terms.

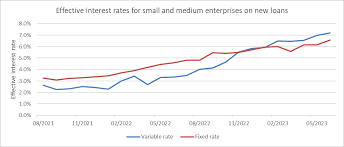

Some lenders provide fixed interest rates while others provide variable business loan rates, the latter of which depends on an index such as prime or LIBOR; fixed rates remain steady over the life of your loan agreement. Before selecting either type, it’s essential that you understand their differences because monthly payments could have a serious effect on your business’s bottom line.

Consider all aspects of financing terms carefully when making decisions about business financing, like short-term business loans with lower interest rates than longer term ones. Furthermore, some loans allow tax law deductibility of their interest payments; however this deduction may have limits imposed by the IRS so be sure to talk with a tax professional beforehand.

Business owners typically seek financing for various purposes, including working capital and expansion. While you can find lending solutions with various interest rates, the most cost-effective solutions typically come from traditional banks and credit unions. You can also secure low-interest financing through smaller community banks/CUs/online banks/microlenders/SBA loans (guaranteed by the Small Business Administration). However, these lenders tend to require stronger qualifications in terms of having strong credit profiles, high revenues and at least two years in business before being approved – some lenders even require collateral as security against loans granted from larger institutions.