US Banks Report Weaker Loan Demand in First Quarter 2024 Fed Survey Says

US banks report weakening demand for industrial loans and declining household credit demand during the first quarter of 2024, long before

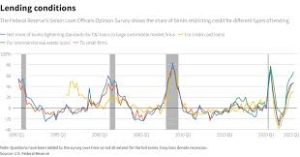

recent stresses in the banking industry erupted with two regional bank failures in quick succession in March. These results come from the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices which inquires into lending standards, terms and demand over three months.

Overall, banks reported tightening standards and terms more quickly from one quarter to another; however, their share that significantly tightened did decline significantly compared to fourth quarter 2016. Commercial real estate (C&I) loans and home equity lines of credit (HELOCs), however, reported more often a change than auto loans or consumer credit loans. Our survey consisted of 64 domestic banks as well as 20 foreign branches or agencies of US-based multinationals providing loans for small, midsize, large businesses as well as households.

On the business side, banks reported tighter standards and weaker demand for C&I loans to firms of all sizes; moderate net share reported similar trends for non-qualified mortgage (NQM) jumbo, subprime, and qualified mortgage (QM) non-jumbo nongovernment-sponsored enterprise eligible loans; modest net share reported tightening standards and terms slightly for GSE-eligible and RRE loans while more moderate shares reported similar trends with auto and other consumer credit loans.

A small net share of banks reported decreased demand for commercial and industrial (C&I) and residential real estate loans; over one third of responding large and midsized banks saw their auto loan demand fall, with community banks holding less than $10 billion in assets witnessing slower loan growth growth rates during this quarter.

The survey asked banks about their reasoning for altering standards and terms across all loan categories in the last quarter. A substantial net share reported citing economic uncertainties as one reason to tighten, while smaller but still substantial shares cited concerns over deposit outflows, funding costs and diminishing collateral values as factors driving changes.

The survey also explored the effect of interest rates on demand for loans by households and firms. Most respondents stated that higher costs had not led them to tighten standards and terms for consumer credit yet, though some reported having reduced limits and/or loan minimum repayments. A few banks also reported modestly shrinking credit lines on net. Some banks that tightened standards in recent quarters cited their desire to limit risk by restricting access to credit while simultaneously raising capital requirements while some also voiced concern over competitive pressures in the marketplace.